We all remember what happened in 2008, and unfortunately, the words “recession” and “housing bubble” immediately bring back memories of the crash.

However, there are big differences between today’s market and the ones leading up to the crash.

Here are the reasons today is nothing like the last time.

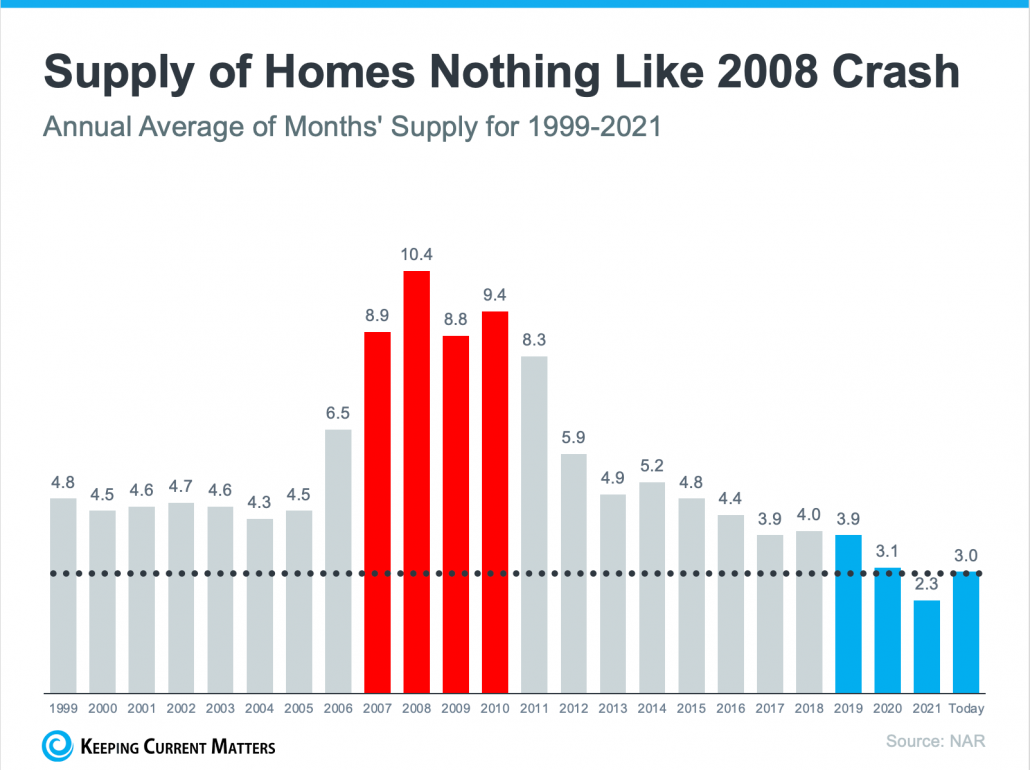

Before the Great Recession, the housing market had:

- Loose lending standards

- An oversupply of homes

- Overtapped equity

Today’s market looks the opposite with:

- Stricter lending practices

- An undersupply of homes

- More equity

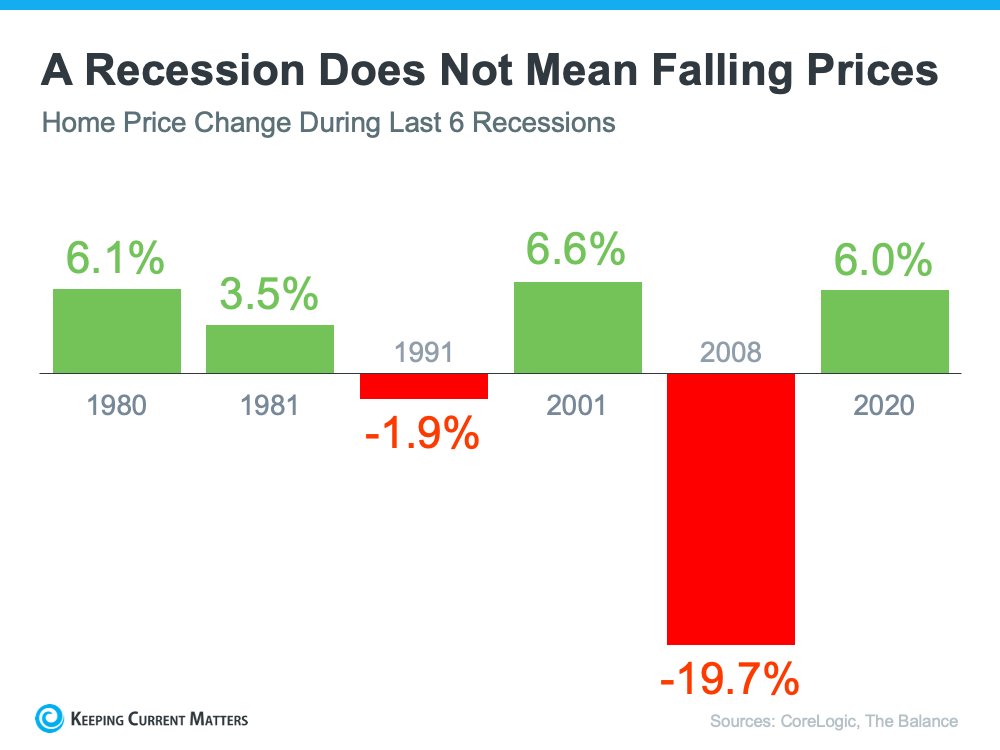

In fact, in four out of the last six recessions home prices still appreciated, and experts project the same for this year’s forecast.